Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

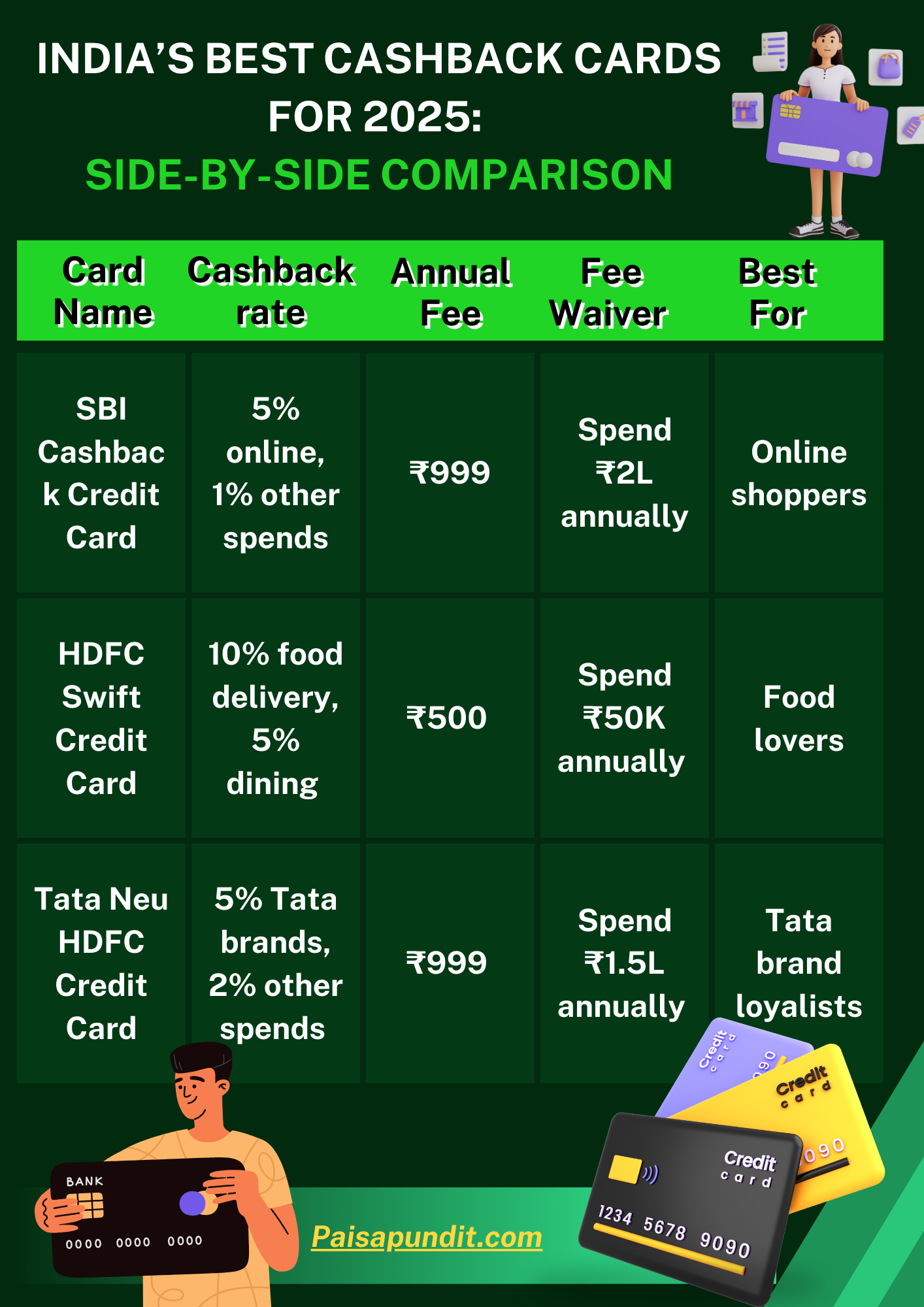

"A comparison table of the best cashback credit cards in India for 2025, showing cashback rates, annual fees, fee waiver criteria, and the best card for online shoppers, food lovers, and Tata brand enthusiasts."

“Do you want to save while you spend? Cashback credit cards can help you save up to ₹25,000 a year!”

In this blog, we’ll explore the best cashback credit cards in India for 2025, perfect for online shoppers, food lovers, and Tata brand enthusiasts. Learn about cashback rates, fee waivers, and rewards, and discover the card that fits your lifestyle.

| Card Name | Cashback Rate | Annual Fee | Fee Waiver Criteria | Best For |

|---|---|---|---|---|

| SBI Cashback Credit Card | 5% online, 1% other spends | ₹999 | Spend ₹2L annually | Online shoppers |

| HDFC Swift Credit Card | 10% food delivery, 5% dining | ₹500 | Spend ₹50K annually | Food lovers |

| Tata Neu HDFC Credit Card | 5% Tata brands, 2% other spends | ₹999 | Spend ₹1.5L annually | Tata brand loyalists |

The ultimate card for online shopping enthusiasts!

This card is a top choice for frequent online shoppers looking to maximize cashback on e-commerce platforms.

Affiliate Link: Apply Now for SBI Cashback Credit Card

Save big on dining and food delivery services!

This card is a must-have for food lovers who frequently order food or dine out.

Affiliate Link: Apply Now for HDFC Swift Credit Card

Unlock maximum savings within the Tata ecosystem!

Loyal Tata customers who shop frequently across Tata platforms or use Tata Neu for purchases.

Affiliate Link: Apply Now for Tata Neu HDFC Credit Card

Cashback credit cards are the easiest way to save while spending. Whether you’re shopping online, enjoying a meal, or shopping with Tata brands, there’s a card tailored to your needs. Apply now to maximize your cashback and make every transaction more rewarding!

[…] What Are Cashback Credit Cards? […]